7.1 RESULTS SUMMARY

The national demand for natural gas in 2016 grew by 2.1% with respect to 2015, mainly due to the increase in industrial, commercial and domestic consumption, and continued its growth during the first part of 2017, in which it grew 6.5% with respect to the same date of the previous year, boosted by industrial consumption.

In this context, MRG has continued to increase penetration in its area of influence, surpassing the 855,000 supply points. To these points must be added the 39,000 LPG supply points, pending switching to natural gas and reaching an approximate figure of 900,000 supply points in total. Regarding the latter, the company’s strategy is to transform it into natural gas, as this is an efficient and sustainable energy source, and thus continue to expand its current gas distribution network in the 59 municipalities in which it has a license to operate.

For MRG, it is important to continue developing a sustainable business model, focused on the growth of the regulated distribution business, the increase in operational efficiency, the financial strength to take advantage of the growth opportunities in its market, the sustainable remuneration to shareholders and a firm social commitment that pursues the creation of value for all our stakeholders.

The regulatory measures applicable to natural gas distribution activity have not undergone any change and the sustainability and control fund on the system’s tariff deficit is maintained. Regulation is a key element in the sustainability of our activities, so that necessary investments are attracted in order to guarantee and expand the distribution of natural gas in an efficient and sustainable manner.

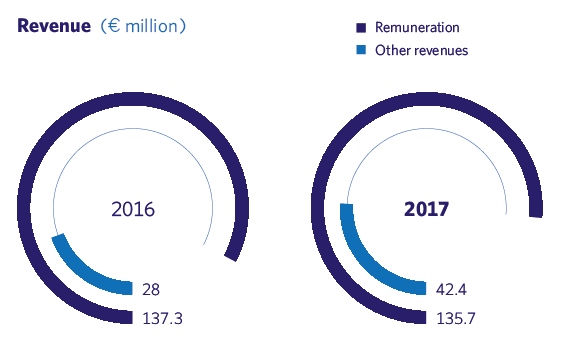

| M€ | 2016 | 2017 | 1In accordance with the International Financial Reporting Standards (IFRS). 2Excluding non-recurrent expenses. |

| Remuneration | 137.3 | 135.7 |

| Other revenues | 28.0 | 42.4 |

| EBITDA2 | 134.2 | 138.1 |

| EBIT | 103.1 | 105.4 |

| Net profit | 49.3 | 48.9 |

In this environment of stability and sustainable growth, our consortium of shareholders remains intact, through Gingko Tree Investment Ltd, PGGM, EDF Invest and Lancashire County Pension Fund, and shares the same vision: the importance and advantages that natural gas represents as a sustainable and efficient energy source, the profile of the company’s business and its commitment to the long-term stability of the current regulatory framework. MRG proposes to its shareholders an industrial project for the creation of long-term value, and it is the trust of our shareholders that allows us to have the necessary resources to carry out this sustainable growth.

MRG’s business model focuses on the growth of the regulated distribution business, the increase in operational efficiency, financial strength, sustainable remuneration for shareholders and a strong social commitment that pursues the creation of value for all its stakeholders

7.2 OPERATIONAL RESULTS

Compared to the previous year, all the main magnitudes have increased, due to the good performance of the operating efficiencies introduced and the partial entry of the LPG supply points.

The gross operating profit (EBITDA) reached € 138.1 million (+3%), and the adjusted gross operating profit (EBIT) for amortization and non-recurring expenses reached € 105.4 million (+2.2%).

At the EBITDA level, the increase is explained by the partial entry into operation of the LPG supply points, the increase in the volume of periodic inspection operations and the reduction of operating expenses, owing to the continuous improvement in automation and the processes. All this has allowed to increase the ebitda by 3% compared to the previous year, despite the impact of lower remuneration and higher expenses as a result of the execution of home operations aimed at combatting fraud.

Similarly, operating results at the ebit level have been increased by 2.2% with respect to the previous year (€ 105.4 million), very similar to the increase in ebitda, since amortizations and non-recurring expenses are practically constant.

In this financial year, EBITDA has increased by 3 % and EBIT by 2.2 %. Total revenues have grown 7.7 %

7.3 REVENUE

Total revenues have reached € 178.1 million, representing a growth of 7.7% compared to those obtained during the previous financial year. Of the total revenue, excluding income from LPG sales (€ 14.3 M), 83% comes from recognized remuneration for distribution activity, fixed on the orders of the Ministry of Industry, Tourism and Commerce No. 2446/2013, published in Spanish State Gazette No. 312 of December 30, 2013; Order No. 2355/2014, published in Spanish State Gazette No. 303 of December 16, 2014 and Order No. 2445/2014, published in Spanish State Gazette No. 312 of December 26, 2014.

The remaining 17% refers to other services related to the distribution of natural gas, mostly regulated (13.5%). These include income from meter rental, periodic inspections, provision of other services to users and income from other non-regulated services (3.5%).

The entry into partial operation of the network assets connected to the LPG plants acquired from Repsol contributed a turnover of € 14.3 million during the financial year.

7.4 FINANCIAL POSITION AND BALANCE

MRG considers financial strength as a strategic pillar that allows it to maintain strong levels of solvency and liquidity ratios consistent with an investment grade rating, balancing the increase in debt with the generation of additional cash derived from new investments. The structure of the debt responds to the profile of regulated business.

In this context, and on April 11, the company completed an operation to issue two bonds under the EMTN programme. The issue was made by Madrileña Red de Gas Finance BV, which lent the funds to MRG through an intercompany loan structure. The issues were € 300 million each, for terms of eight and 12 years, and it received the investment grade credit rating from the international rating agencies, Standard & Poor’s and Fitch. The programme is guaranteed by Madrileña Red de Gas and deposited in the Luxembourg Stock Exchange. The funds obtained will be earmarked primarily for the amortization of € 500 million in bonds, due September 2018, while the rest will be used for different corporate purposes.

Through this new financing, MRG has managed to reduce the cost, increase the term and eliminate the risk of interest rate variations; in particular: reduce the average cost of financing from 3.1% to 2.7%, increasing the average life of the debt from 6.2 years to 8.9 years and closing 100% of its debt at a fixed interest rate.

At the same time, the company has secured a contingent credit line (Revolving Credit Facility) with a group of four banks for a total of € 200 million, for a term of five years, in terms significantly more advantageous than the lines previously in force for € 175 million. This line allows us to increase our liquidity position with absolute flexibility to dispose of the aforementioned funds.

In conclusion, and comparing with our counterparts in the distribution sector, MRG is the only company that has the following advantages: debt financed in the long term (average life of the debt = 8.9 years), without risk of interest rate (100% fixed rate), at the most competitive price (2.7%) and with a liquidity line for € 200 million at five years with absolute flexibility to dispose of these funds.

In this financial year, an operation to issue two bonds was completed by Madrileña Red de Gas Finance BV. The issues, of € 300 million each, received the investment grade credit rating from the international rating agencies, Standard & Poor’s and Fitch

| M€ | 2016 | 2017 | 1In accordance with the International Financial Reporting Standards (IFRS). |

| Gas distribution licences | 713.4 | 740.3 |

| Net tangible fixed assets | 355.7 | 380.8 |

| Total Network Fixed Assets | 1,069.1 | 1,121.0 |

| Goodwill | 57.4 | 57.4 |

| Deferred tax asset | 27.3 | 26.3 |

| Other non-current assets | 29.9 | 53.6 |

| Current assets | 47.2 | 35.6 |

| Cash | 111.4 | 598.6 |

| Total Assets | 1,342.3 | 1,892.5 |

| Equity | 369.3 | 323.3 |

| Subordinated Shareholders Loan | ||

| Long term debt | 846.7 | 1,442.2 |

| Deferred tax liability | 25.7 | 35.4 |

| Other non-current liabilities | 20.1 | 24.1 |

| Current liabilities | 80.6 | 67.4 |

| Total Liabilities & Shareholders equity | 1,342.3 | 1,892.5 |

| M€ | 2016 | 2017 | 1In accordance with the International Financial Reporting Standards (IFRS). 2Excluding non-recurrent expenses. 3Deficit 2014 and 2015 are excluded. |

| EBITDA2 | 134.2 | 138.1 |

| Income tax paid | (12.0) | (8.8) |

| Working capital3 | 1.4 | (6.7) |

| Capex | (15.7) | (15.1) |

| Free cash flow2 3 | 107.8 | 107.5 |

7.5 OPERATIONS CASH FLOW

The cash flow generated by ordinary operations during the year was € 107.5 million, maintaining a level similar to the previous year.

The improvement in the operating margin as a consequence of the operational efficiency in the processes, the increase in other regulated revenues and the temporary reduction of the investment as a result of the agreement reached with Repsol for the purchase of the 41,600 LPG supply points, which will be transformed to natural gas in the coming years, have been the main factors that have contributed to the maintenance of cash flow generated in the year.

Also noteworthy, in the non-recurring or extraordinary items of the year, is the acquisition from Repsol of the LPG plants for € 61.5 million and the € 19 million corresponding to the distribution of the definitive system deficit for 2014 and 2015.

The cash flow generated by ordinary operations was € 107.5 million, maintaining a level similar to the previous year

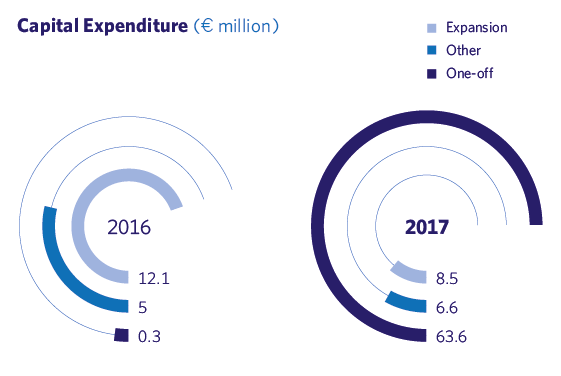

7.6 INVESTMENTS

With the objective of expanding the distribution of natural gas to the greatest number of consumers, MRG has continued with the investment plan in its area of influence. During the current year, the payments made to finance the investment in fixed assets reached a figure of € 78.9 million.

In view of its essential characteristics, investments or investment commitments in 2017 can be grouped into four main areas:

ACQUISITION

At the end of 2016, MRG acquired 516 LPG plants and their network assets from Repsol, with 41,054 supply points connected, for approximately € 61.5 million.

EXPANSION

The company’s strategy is focused on the expansion of its distribution network in the 59 municipalities in which it has a license to operate. MRG has invested a total of € 15.2 million in this area.

CONVERSION TO NATURAL GAS OF LPG POINTS

Regarding the acquired supply points, the company’s strategy is to transform these points into natural gas, as this is an efficient and sustainable energy source, and thus be able to continue expanding our current gas distribution network. During this year, MRG has already converted 1,900 LPG supply points to natural gas.

OTHER PROJECTS

In this financial year, we have intensified our efforts assigned to the efficiency in the telematic control of all the automatic systems of the distribution network and in the development of an information system aimed at combating fraud.

Through these investments, MRG will continue to improve operational efficiency thanks to advances in automation and digitalization in all processes. In the coming years, the efficient operation of the assets in operation, together with the investment plan described, will lead to a sustainable growth of the cash and the results of the company.

The data reflected in this report correspond to the annual financial year, between July 1, 2016 and June 30, 2017.

The detail of the annual accounts and the reports of the auditors are available online in the Investor relations de www.madrilena.es.