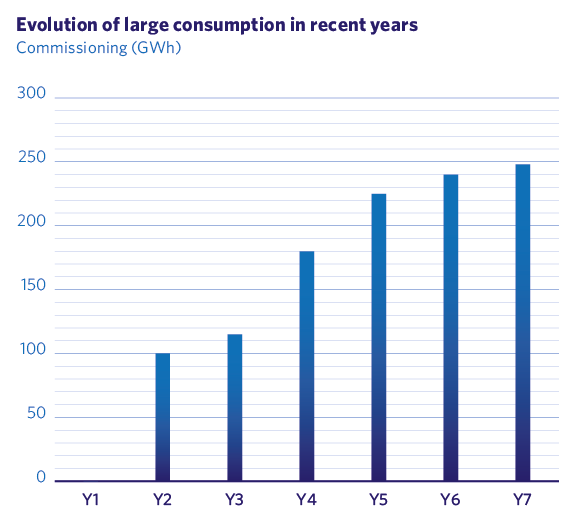

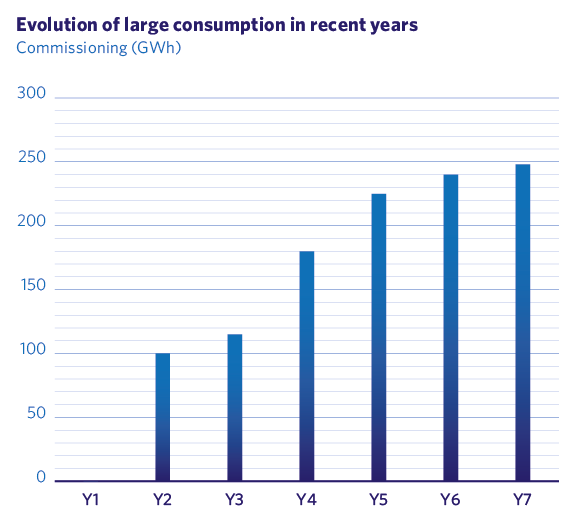

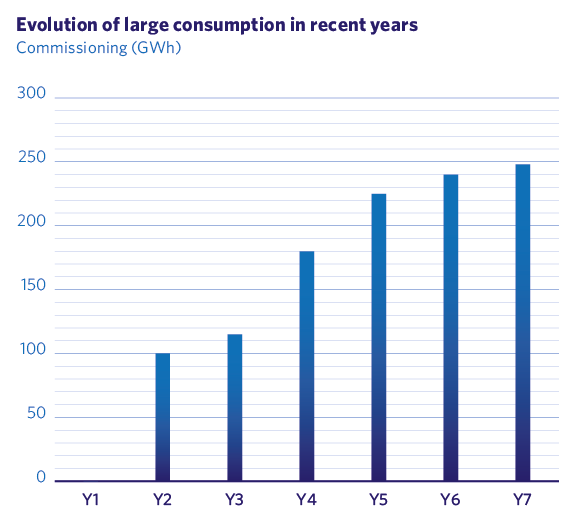

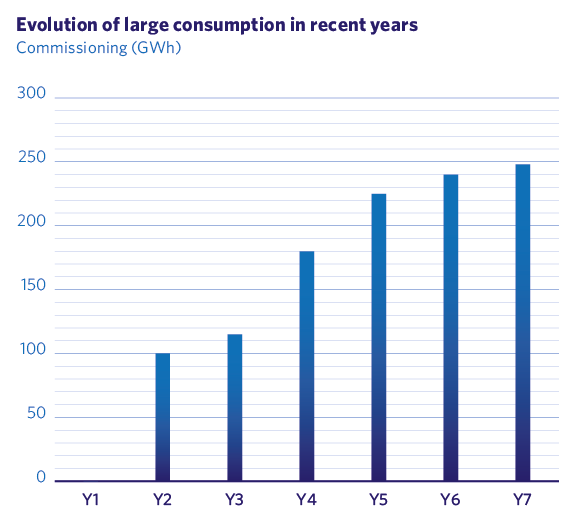

2.1 LARGE CONSUMPTION

In Madrileña Red de Gas, the mass market has experienced exponential growth over the years, which has entailed ongoing evolution of the equipment and the tools that have favoured the efficient development of our commercial activity.

In MRG’s scope of action, this has enabled a penetration in consumption (GWh) to be at present 55%, with a supply points consumption of tariffs regarded as large consumption (tariff 3.3 hereinafter) of 3.215 GWh, which represents 35% of the total gas transported in the company.

This constant growth of the large consumption mass market has required a potential implementation plan, which consists of preparing an in-depth study to identify potential customers in the scope of the company and of the creation of a more dynamic, agile and visual geo-positioning tool for existing and potential customers.

The identification of these customers has been undertaken by the twin method, based on the comparison and contrast of information with MRG customers in service and with all existing companies within the SABI database. For the classification, identification and extraction of the potential of active companies in our scope of action, we have counted on the collaboration of the consultancy firm, PricewaterhouseCoopers.

This study has enabled MRG to have reliable and complete information on a changing and difficult-to-access sector such as the industrial sector. This information guarantees effective commercial work, based on updated and classified economic criteria with real potential. The study was undertaken in three phases:

- Obtaining relevant external information, based on databases and aggregate information — Top-Down Analysis — which has allowed the understanding of consumption patterns by activity sector.

- Obtaining internal company information.

- Selection of clustering variables that have enabled, by internal and external information crossover, the identification of potential customers with behaviours analogous to those already existing. It has also enabled calculations of Customer Equity or theoretical value of the potential customer and conversion Payback to be performed.

Among the first results obtained during this financial year, we can highlight the contracts with different companies and institutions of the Community of Madrid, some of which include: Martinrea International Inc., in Móstoles, the Iberdrola Campus in San Agustín de Guadalix, the National Microbiology Centre, in Majadahonda, and the Aliara Energía NGV service station in the municipality of Madrid. We have also carried out various actions with the Administration of the Community of Madrid in the institutional, health and educational environment.

On the other hand, the development of the customer geo-location tool, both for existing and potential customers, has enabled all the information to be available on a single platform through which we can visualize our distribution networks, monitor the commercial actions of our “extended company”, update existing data and / or generate new potential customers directly through our website or the App version.

One of our challenges is to improve the perception that MRG customers have, and this new tool has made it possible for us to be more efficient in dealing with their demands and doubts, offering a solution to all their concerns, with products and services totally segmented in function of the profile of each customer, propose offers adapted to different needs and streamline contracting procedures.

In constant growth and with a range of products and services segmented according to the specific profile of each customer, large consumption represents for Madrileña Red de Gas 35 % of the total gas transported by the company

2.2 NEW CONSTRUCTION

In this financial year, Madrileña Red de Gas has experienced an 8% growth in new construction. We have gone from the 3,414 homes in service last year to the current 3,692 homes. Of these, an important part (55%) refers to fully detached homes.

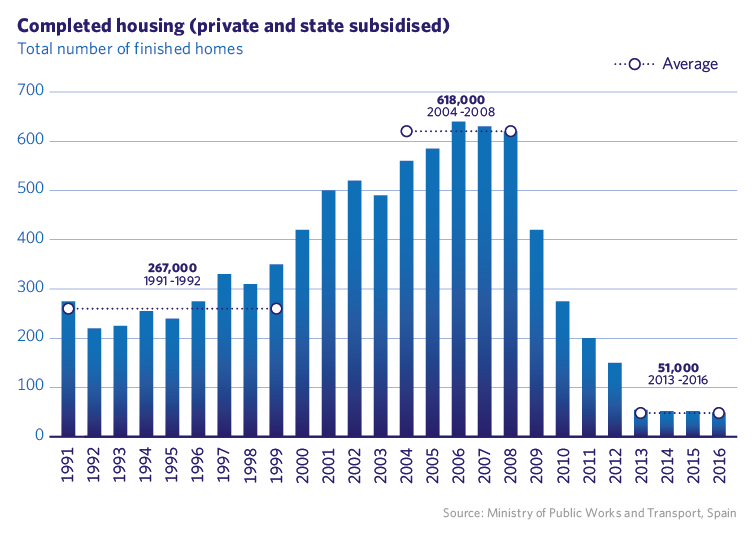

According to data from the Ministry of Development, the granting of building permits in Spain attained 22% growth during the first nine months of 2016, compared to the same period of the previous year, and 32% in new building permits. The Community of Madrid leads this activity, with 27% of the total number of permits granted.

New build homes in Spain totalled 42,000 units. Of these, 6,000 were built in the Community of Madrid. Within the MRG distribution area, 3,692 had a natural gas supply.

The figures are slowly improving, but are still lower than the figures that were reached during the years preceding the crisis in the sector. Even so, we expect the expansionary trend to continue, as low interest rates, private deleveraging and better economic prospects are encouraging residential investment throughout the country. It is estimated that from 2018 the potential demand for housing will be between 170,000 and 180,000 homes per year.

Approximately one in every seven homes (about 25,000) will be built in the Community of Madrid, where the demand for new housing displays greater intensity than in the rest of the regions, and where the need for construction is also greater. It should be noted that the municipalities where MRG is present are those that register a higher demand (between 12,000 and 15,000 homes).

On the other hand, the sector has been reshaped after the crisis, and today the main promoters combine the experience of traditional residential developers with the financial and business vision of their new capitalist partners, often with foreign finance. This alliance is contributing to a greater professionalization of the sector.

The new regulation, resulting from the application of the latest European guidelines on the matter, affects the energy consumption of new building. The houses that are built from 2020 will have more restrictive limitations in terms of energy demand, which will be at 40 KWh / year m2 (a value that currently ranges between 80 and 100 KWh / year m2). There will also be a restriction on primary energy to meet that energy demand.

This financial year, MRG has experienced an 8 % growth in new construction: of the 3,414 new homes in service last year, we have gone to 3,692, of which 55 % represents single-family homes

2.3 LPG PROJECT

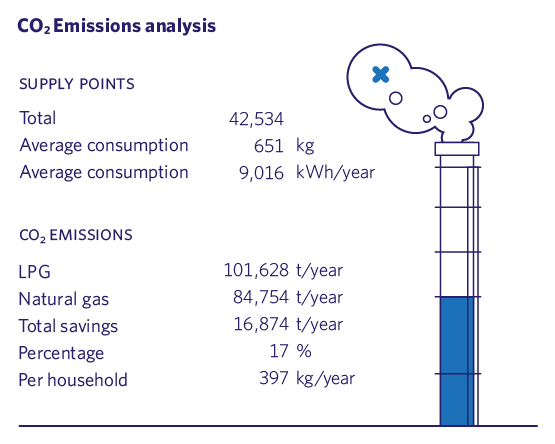

The ambitious project of transforming LPG plants to natural gas (about 42,000 supply points) began at the end of April 2016, and at the close of our financial year in June 2017, 76 plants had already been transformed, which means 1,986 new natural gas consumers.

Owing to the implementation of innovative IT tools for the geolocation of plants and supply points, we have reached a switching rate of 1,000 monthly supply points. In approximately three years, we will have completed the switching to natural gas for all our customers.

To undertake this process, MRG has worked with 14 installation companies, which undertake the technical adaptations required, and four new supply point companies with switching; all of them reputable.

This process lasts approximately between 35 and 90 days per LPG plant, depending on the complexity of the reception facilities, the proximity of the plant to the natural gas distribution network and the application for licenses from the respective municipalities.

The commissioning has been carried out in four stages:

- Census of appliances and facilities

- Adaptation of the natural gas distribution network

- Adaptation of the facilities

- Switching of appliances and discharge of the supply point

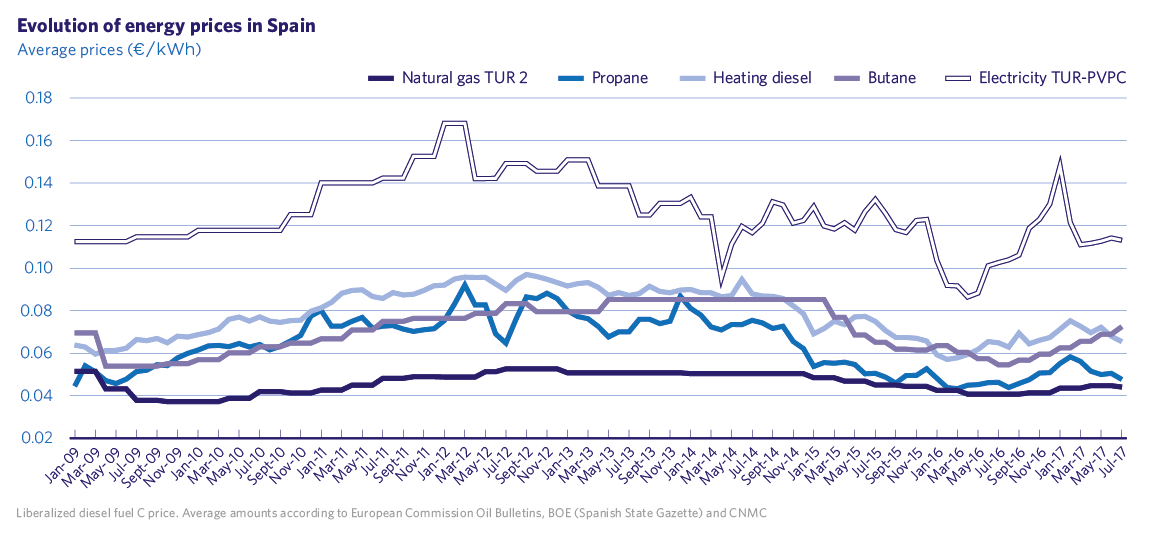

From an economic point of view, this switching to natural gas brings considerable advantages. Since LPG is a petroleum product, it is subject to the existing refining and demand capacities (it becomes more expensive during the winter season and cheaper in the summer), and therefore the fluctuation in its price is higher than in natural gas.

Taking into account that LPG’s average consumption is 650 kg / year (9,000 KWh / year), and that most of the consumption occurs in winter months, with the switch to natural gas the average customer obtains important economic advantages.

Of the 516 LPG plants acquired in 2016 from Repsol, equivalent to 41,600 new supply points, 76 have already been switched to natural gas, which means 1,986 new consumers of clean energy

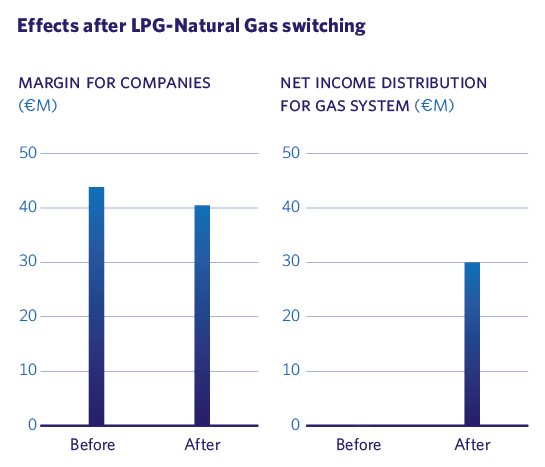

Similarly, the switching of these LPG plants to natural gas also involves considerable advantages for the gas system, as it translates into revenues of more than € 30 million.

From the point of view of safety, all the LPG installations that are transformed comply with the current regulations, resulting in an increase in the safety of facilities.

Regarding the environmental advantages, it is well known that natural gas is one of the most environmentally friendly energies. Being its lightest molecule and containing only one carbon atom, it produces cleaner combustion than propane, which translates into 40% less CO2 emissions. In concrete figures, the complete switching of the 516 LPG plants acquired will mean a saving of 16.8 tons / year of CO2.

Among the natural gas marketers that have been interested in our project are Endesa, Cepsa and Iberdrola.

2.4 RESIDENTIAL MARKET AND NGV

The increase in pollution in the municipality of Madrid has led to the multiplication of restrictive measures for the access of vehicles to the city. In this context, NGV has a considerable competitive advantage, since hybrid vehicles that combine the use of natural gas with petrol are classified as ecological vehicles, which allows them to circulate freely.

A large part of the new construction, with predominance of the single-family housing, is carried out in Madrid’s metropolitan ring, MRG’s scope of action. In the medium term, the owners of these new homes will find it difficult to access the city centre with their conventional vehicles. Therefore, during this year, one of our challenges has been to disseminate among promoters and future buyers of new homes the advantages of the joint use of NGV and domestic natural gas, and to implement the pre-installation of NGV from the beginning of the project in single-family homes, as well as the design of effective and affordable solutions for their implementation in collective housing developments.

Owing to its commitment to strengthen its commercial activity and the signing of agreements with different agents and partnership institutions, in this financial year MRG has grown in all the sectors of activity

2.4 COLLABORATIONS

In order to promote and implement the NGV in the network of dealers and workshops of the Community of Madrid, in this financial year MRG has signed an agreement with AMDA (Madrid Association of Automobile Distribution).

The collaboration with Agremia (Installations and Energy Sector Association) has also been maintained, with an increase in the market of vertical saturation of 3% with respect to 2016. In addition, additional measures have been developed that favour a greater level of involvement of the installation companies in the marketing of new natural gas supply points.

Similarly, we have extended the partnership agreement with the Energy Foundation of the Community of Madrid and various companies and associations in the sector for the development of the Boiler Room Renewal Plan.

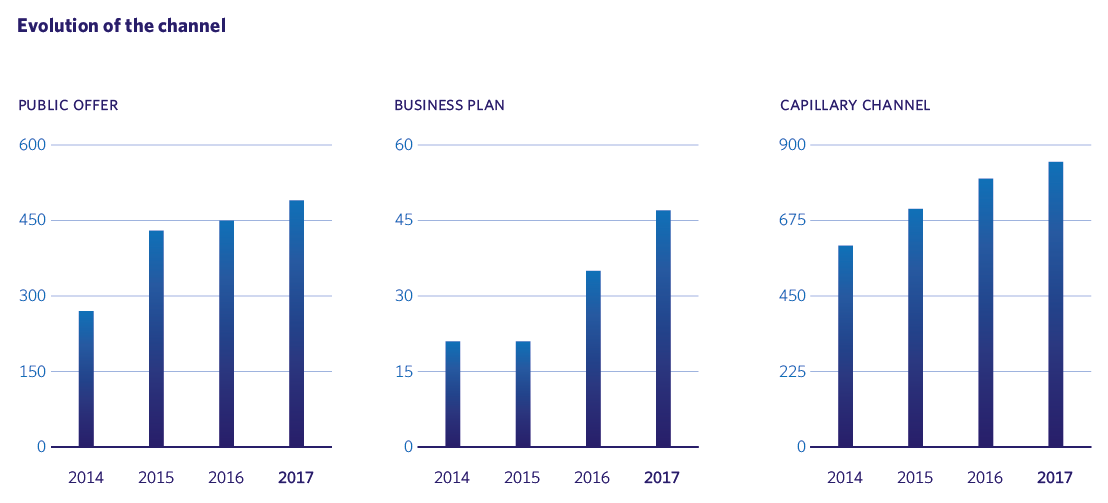

On the other hand, we have maximized our commercial activity with reputable partners. Currently we have 164 agents, representing a growth of 9% over the previous year. In addition, a majority has subscribed to our commercial plan (with half-yearly validity) for the residential market and for the large consumption. The result: an increase of 30% compared to the previous year.

The data reflected in this report correspond to the annual financial year, between July 1, 2016 and June 30, 2017.